SCHD Stock Overview

Blog

Diversify Your Portfolio with SCHD Stock: A Comprehensive Guide

Are you looking to add a dividend-focused investment to your portfolio? Look no further than the Schwab US Dividend Equity ETF, commonly referred to as SCHD stock. As one of the most popular dividend ETFs on the market, SCHD provides investors with a diversified portfolio of high-quality dividend-paying stocks.

Are you looking to add a dividend-focused investment to your portfolio? Look no further than the Schwab US Dividend Equity ETF, commonly referred to as SCHD stock. As one of the most popular dividend ETFs on the market, SCHD provides investors with a diversified portfolio of high-quality dividend-paying stocks.

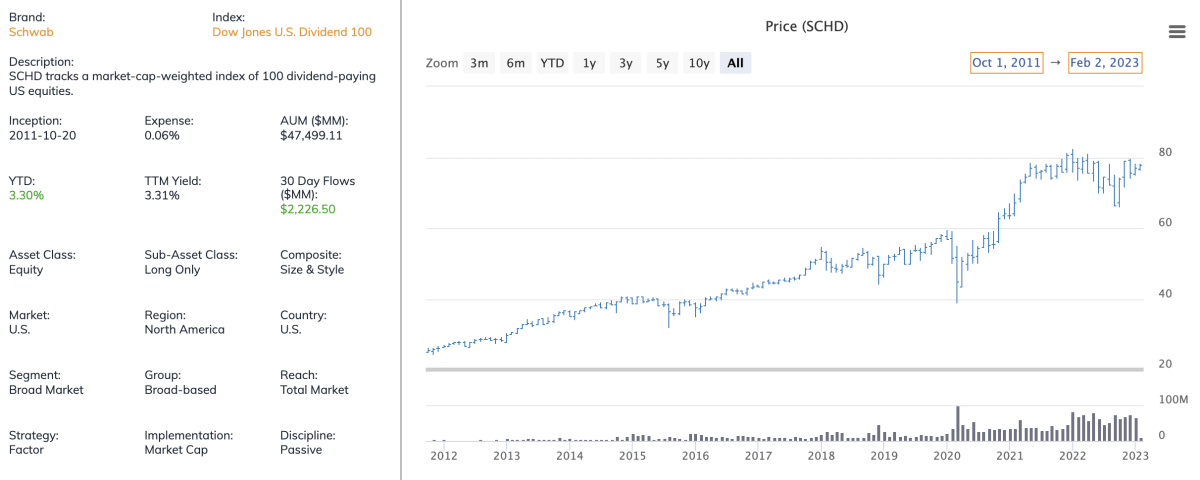

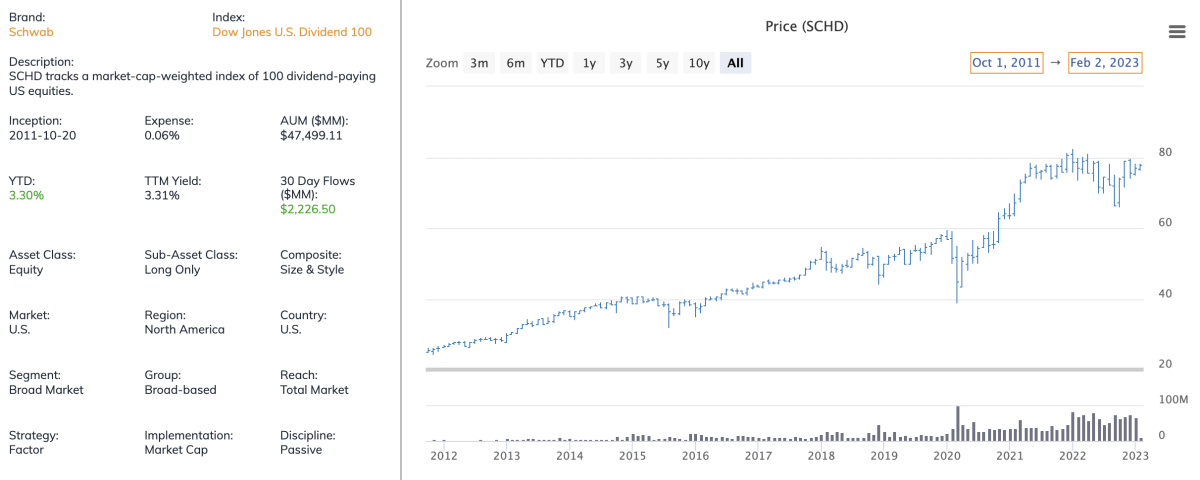

SCHD is an exchange-traded fund (ETF) that tracks the Dow Jones US Dividend 100 Index. This index is composed of the top 100 dividend-paying stocks in the US market, with a focus on quality and sustainability. The ETF uses a rules-based approach to select its holdings, ensuring that investors receive a consistent stream of income.

SCHD is an exchange-traded fund (ETF) that tracks the Dow Jones US Dividend 100 Index. This index is composed of the top 100 dividend-paying stocks in the US market, with a focus on quality and sustainability. The ETF uses a rules-based approach to select its holdings, ensuring that investors receive a consistent stream of income.

Investing in SCHD stock offers several benefits for investors:

Income Generation: With a focus on dividend-paying stocks, SCHD provides investors with a regular source of income.

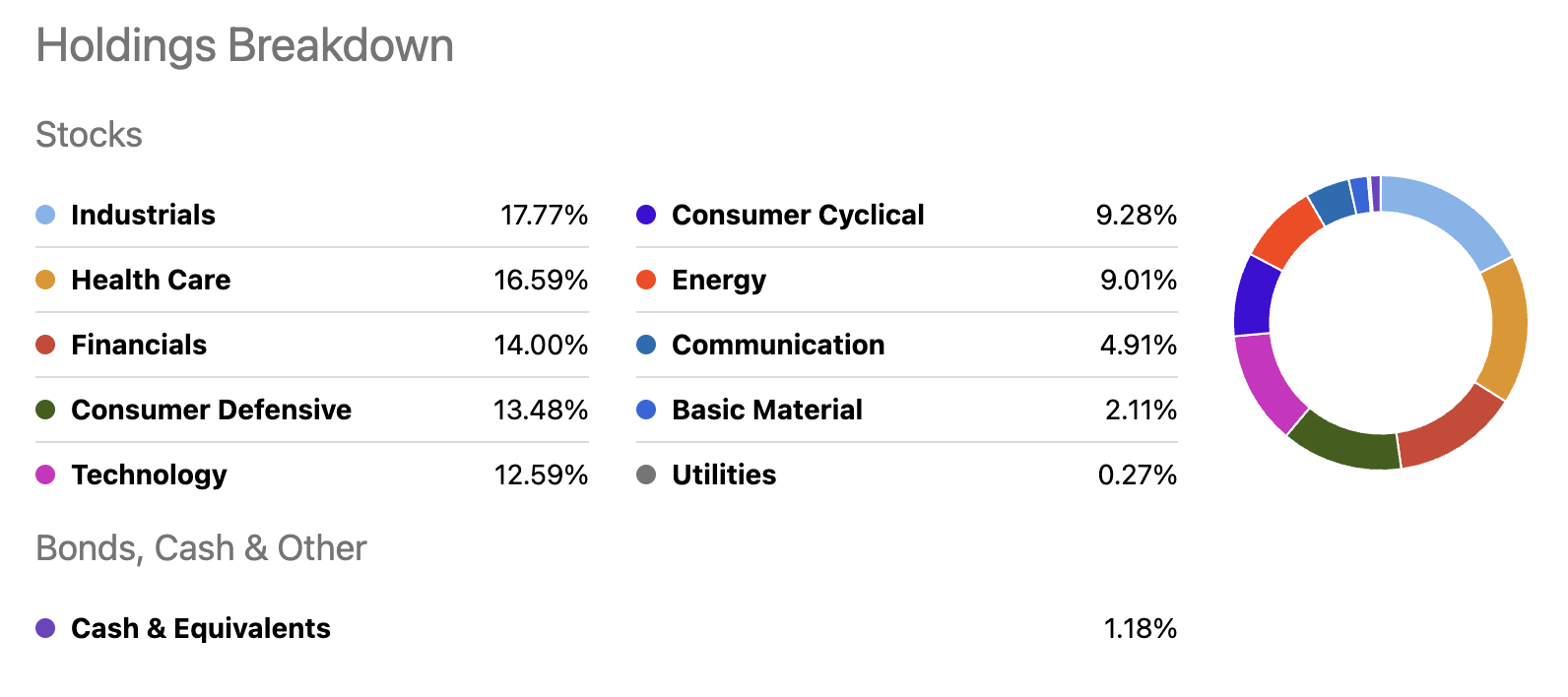

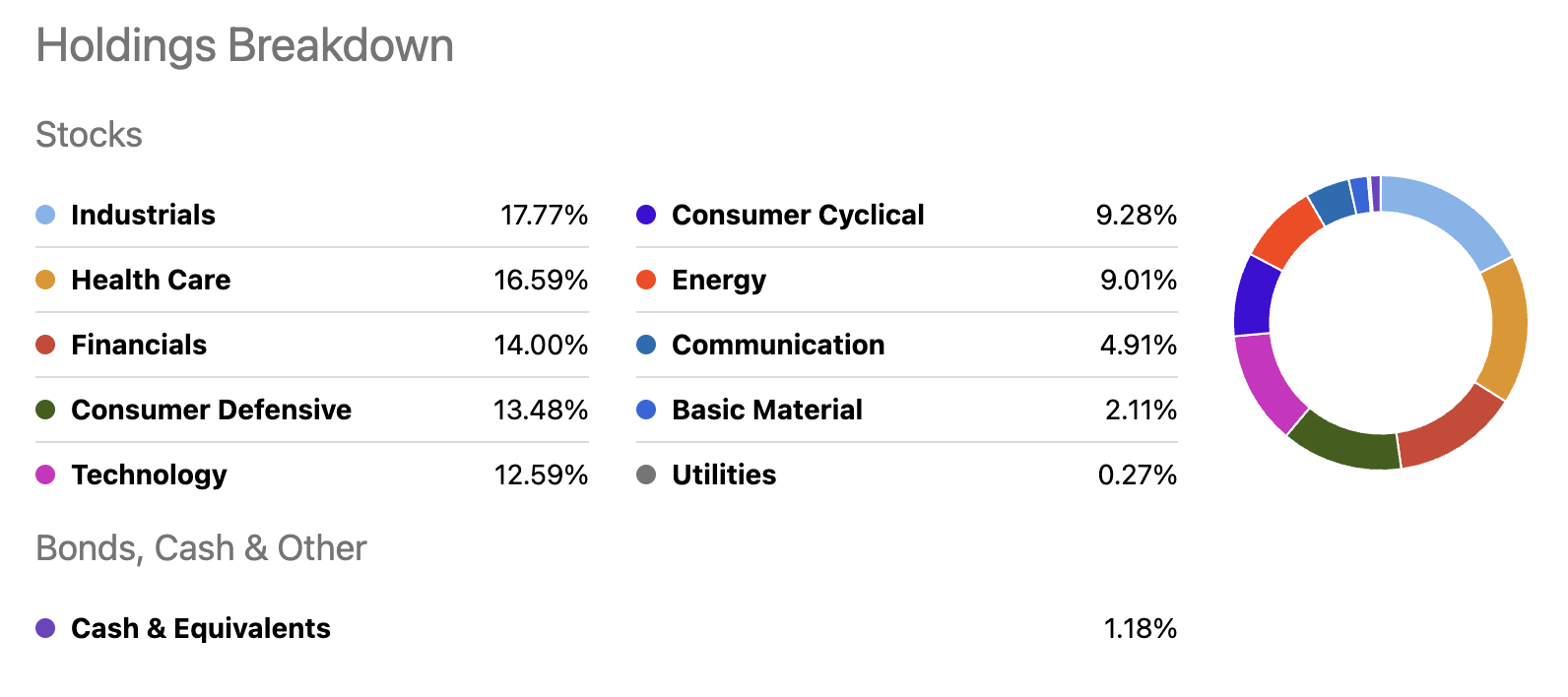

Portfolio Diversification: By investing in a diversified portfolio of high-quality dividend stocks, investors can reduce their exposure to individual stocks and sectors.

Low Cost: As an ETF, SCHD has a low expense ratio compared to actively managed funds.

Transparency: With its rules-based approach, investors have complete transparency into the selection process for SCHD's holdings.

Investing in SCHD stock offers several benefits for investors:

Income Generation: With a focus on dividend-paying stocks, SCHD provides investors with a regular source of income.

Portfolio Diversification: By investing in a diversified portfolio of high-quality dividend stocks, investors can reduce their exposure to individual stocks and sectors.

Low Cost: As an ETF, SCHD has a low expense ratio compared to actively managed funds.

Transparency: With its rules-based approach, investors have complete transparency into the selection process for SCHD's holdings.

Table of Contents

- I'm the guy that made that SCHD post... Here is a better visualization ...

- SCHD ETF stock nears its death cross amid rotation to Treasuries

- Schd June 2024 Dividend - Marje Shandra

- SCHD: Stringent Selection Process Helps Identify The Best Dividend ...

- Why YOU Should Own SCHD In Your Dividend Portfolio | SCHD Stock ...

- SCHD's Yearly Reconstitution Adds 14 New Stocks And Eliminates 13 ...

- Schd Next Ex Dividend Date 2025 - Addy Crystie

- This Dividend ETF Can be a Cornerstone of Your Portfolio

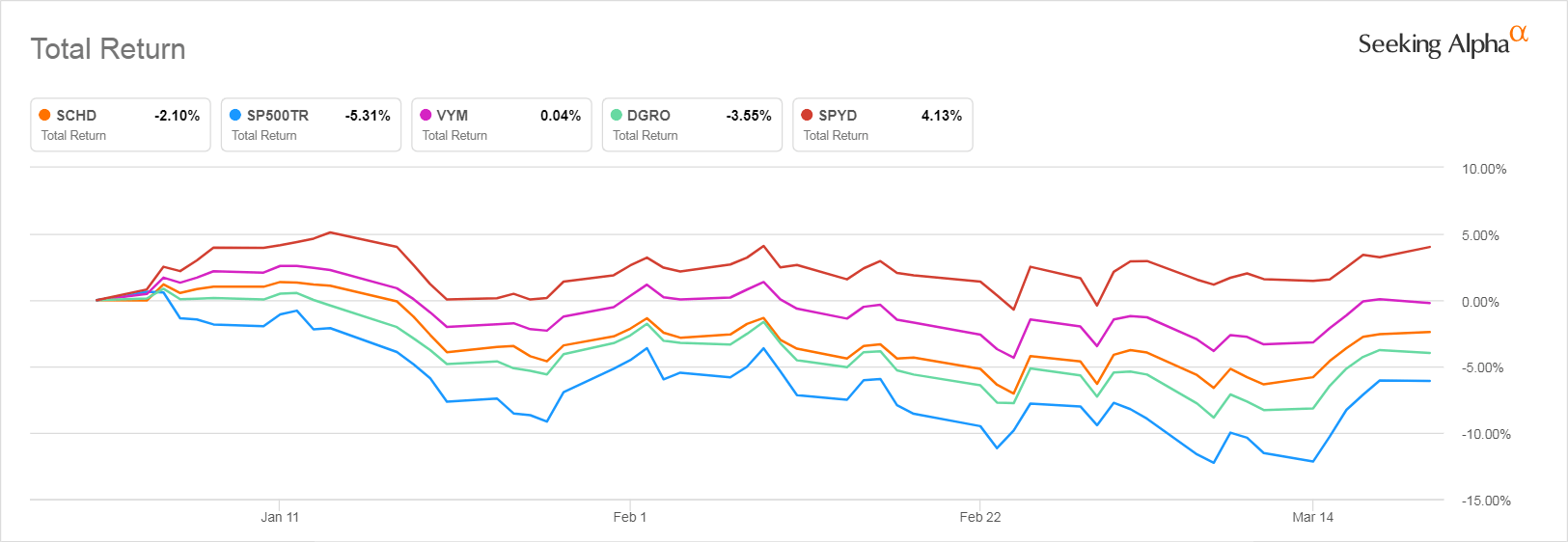

- SCHD ETF: So Far So Good | Seeking Alpha

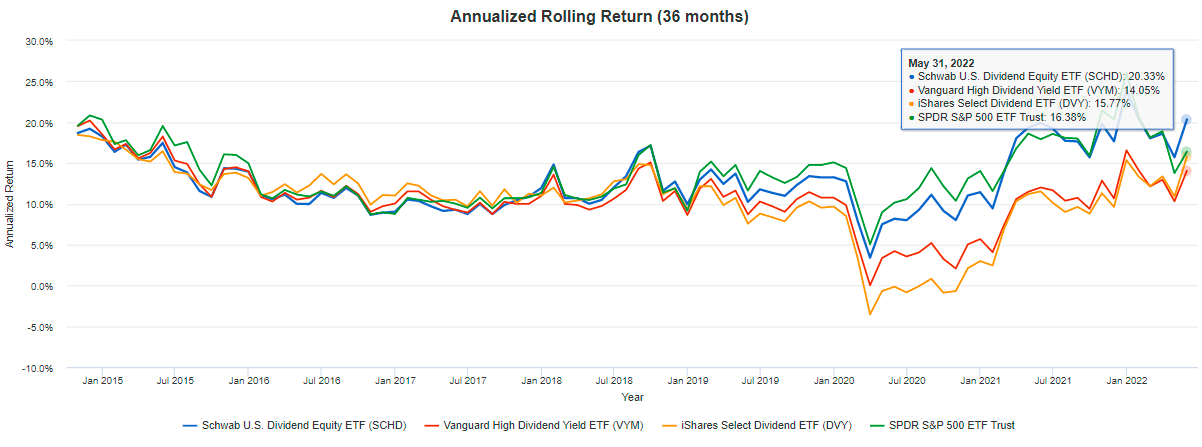

- SCHD: 3.50% Estimated Yield, 12% Dividend Growth, And More | Seeking Alpha

What is SCHD Stock?

Why Invest in SCHD Stock?

How Does SCHD Stock Work?

SCHD works by tracking the performance of the Dow Jones US Dividend 100 Index. The ETF holds a portfolio of stocks that are selected based on their dividend yield and sustainability. The selection criteria include: Dividend Yield: Stocks with a high dividend yield are more likely to be included in the portfolio. Sustainability: Companies with strong financials, low debt-to-equity ratios, and a history of paying consistent dividends are given preference.